Why Africa’s Minerals Are Changing the World!

Motherland Investors

May 29, 2025

VJ: You probably already know this, but the future of the Cobar economy is digital. But what you might not know is most of the resources needed for digitalization are found in Africa, from lithium for electric car batteries, to cobar for cell phones and uranium for nuclear energy to power your tech and your AI, as well as so many minerals.

They are all found on the African continent, and as we speak, there’s a scramble for Africa, which means it’s going to shape the global economy. But the question is, will you be part of this revolution or will you be standing on the sidelines?

Hello everyone. Welcome. I’m Sylvia and I’m truly to have you all here. We have a lot to talk about, so let’s dive into it. When we look at the world today. It’s obvious we are on the brink of a great shift. The US dollar is on shaky grounds like never before. The global South is rallying to overthrow the west, and alliances like the bricks are growing stronger every day.

Financial powerhouses like the US, seem to be a thing of the past as more and more countries are being bored enough to stand up and see. They don’t want a war with a single hegemony. Inflation is already at an all time and financial experts are predicting a recession, and when that happened, it’ll be too late, unfortunately, to get out.

So my question for you today is, what’s your plan when this collapse eventually happened? Let me share a quick story. In 2018, I was working for a portfolio management company. I was going about my business as usual, not a care in the world. Focus on climate, the corporate ladder. Securing the bag when one day at work I received an email saying that my company was sending me over to Singapore.

They had been receiving a lot of requests from wealthy Chinese clients who wanted to get into the African market, and since, as I was only African in the company and the only one who knew anything about African markets. I was being sent to Singapore. You remember the day I received that email? It was like a dead sentence.

Trust me. I felt so bad here. I was working to conquer Europe and my European clients, but Africa wouldn’t just let me go. I was devastated to say the list. But what choice did I have? So after Singapore, I went from the moment I landed in Singapore, I was whined, dined. Court by wealthy investors from China, India, Malaysia, Turkey, the UAE, and even from Europe, each one of them wanting a foothold.

In Africa, I was mind blown, to say the least. I’ve always loved Africa. I’ve always had the soft spot for Africa, but I never looked at it in terms of business or creating wealth. I never associated before that point. I’d never it with worth creation. It was just hope. A place where you live, go and get an education, make money and come back.

And that was it. But working for this world investors in Singapore. Change my whole perspective. I spend the next five years helping all sorts of investors, businesses, and franchises diversify into the African market. Then after about five years of analyzing and dissecting every corner of the African market, this is what I found out.

I came to a shocking realization, something that will change my whole perspective and alter my trajectory. I noticed that even though everyone wanted a piece of Africa, the only people not remotely interested about owning a chunk of the continent were black people. Yes, black people be black Americans, Afro-Caribbean, African diaspora, and Afro descendants.

In general, it was simply not interested in the continent. Unlike me. Never saw it as an opportunity in all my years of consulting. I never came across one black who was interested in diversifying their portfolio into Africa, and that got me thinking. I had consulted for every other race under the sun.

But black people, this shoot me to the core and I set out on the course to find out why. Why are black, who are the divine owner of the resources on the continent, not want to be a part of it. Everyone with the original owners. Saw potential on the continent. I started digging deeper, and this is what I found out.

I found out that black people had been misinformed, lied to, and kept in the dark. When it came to the African continent, I found out that black people, black awareness. Information on the opportunities available on the continent. They were either misinformed or uneducated when it came to Africa. I don’t know if the misinformation is done intentionally or not, but that’s a conversation for another day.

Africa, as so has been hidden and mystified to black people outside of the continent with this realization. I quit my job. Moved back, who determined that educating Afro descendants and the African diaspora about the amazing opportunities found in the continent. And to take advantage of some of them myself, I bought a bunch of African stocks and started a couple of businesses across the continent.

And I haven’t looked back since. Some of those businesses failed and others are thriving till this day, and I have even sold some of them for over a hundred x my initial investment. This is why I strongly believe African markets are the fastest way to financial freedom and building generational wealth, especially for black people.

This masterclass. Isn’t about facts and figures. You can find those everywhere on the internet. It’s about opening your eyes to what might be the most lucrative investment opportunities. Generation and giving you practical steps to seize these opportunities while you still kind By the end of our time together, I strongly hope you understand why Africa is a once in a lifetime opportunity for smart investors.

Which specific sectors on the continent are prime for success? How to avoid common mistakes and pitfall that wreck most investors, and most importantly, concrete next steps you can take to begin your journey today. First of all, let me throw in some facts. I know I said this presentation isn’t about facts and figures, but just for context, aside from the fact that Muslim natural resources needed for the digital world to function are found in Africa, Africa is 1.3 billion.

People. That’s a huge market and an even bigger workforce. According to the World Bank Index, by 2051 in every four people in the world is going to be Africa. Let that just sinking. Moreover, 500 million of these people estimated to be middle class by the next decade as we speak. Right now, Africa has 570 million.

Internet users 570 million because most of the population is young. The median age is 19 years old. Experts say this generation is leapfrogging traditional development patterns. It’s like nothing that I’ve ever seen before. That’s Africa in a nutshell. But on the other hand, there’s the west and the West.

That talks of a recession, a huge one, probably even bigger than the Great Depression. Most people are already feeling it. The inflation. The high prices, the tariffs, and it’s only going to get worse. As economic power shifts from the west to the global south, this is not going to be one of those recessions where you sit tight and hold onto your portfolio, hold onto your wallet, and don’t spend money hoping that you’ll roll over.

No, it’s not one of those you’ll get wiped out. Your secure job, your savings, your investments, and even the value of your house. It’s going to get hit so hard unless you protect yourself. And the only way through this is by diversifying your portfolio into an opposite market. A market that is prime for growth, but despite the chaos, some parts will grow because they have much needed resources.

The question is no longer if Africa will grow. That’s a giving. The question is, will you be part of that growth? Let’s take a closer look at some of the opportunities on the continent that you can decide to leverage. Number one, FinTech and digital services. 60% of the African population is on bank. This means they don’t have bank accounts, but here a kicker.

It’s estimated that most parts of the continent. Have an 80% mobile phone penetration. You see where I’m going with this? You see, you see there’s a huge gap in the market right here, and smart investors love market gaps because that’s where generational wealth is made. FinTech as a solution here is a gold mine.

Companies like Pesa from Kenya flat away from Nigeria, which has been valued at about $3 billion and pay stock, which was recently purchased by Stripe for a whooping. $200 million are key examples in Africa. While not inventing the we while just doing what has proven to work elsewhere, we just copying and pasting.

The same systems that have worked in the west, bringing them to Africa because Africa needs that infrastructure. No need to test and try just adapt to the market. Just to put things in perspective, investment in the FinTech sector grew from $130 million in 2016 to $5 billion in 2024 with that kind of money at play.

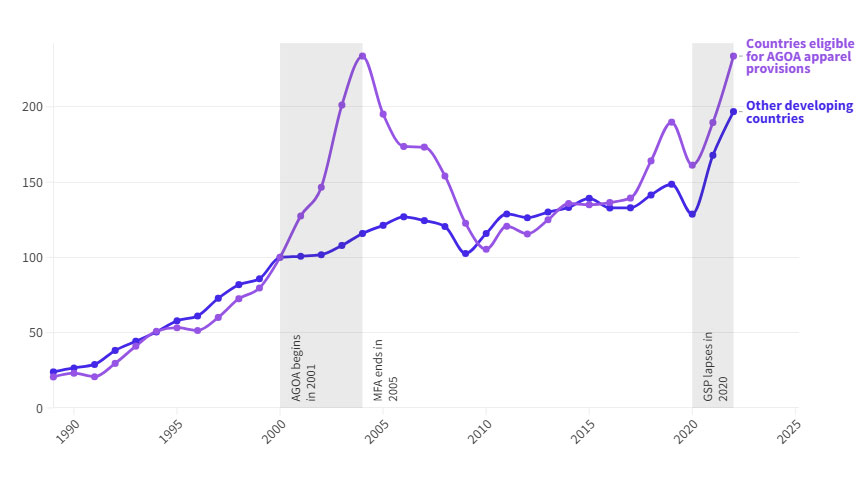

How can you sit on the sideline? The next opportunity you want to be looking at is in manufacturing. We can’t say enough about African manufacturing. Africa is already positioning itself as a next global manufacturing hub. Countries like Utopia and Morocco are already leading the way, Ethiopia. With textiles and Morocco, we cars.

It may seem farfetched, but a few decades ago, no one could ever believe that manufacturing could leave the west to move to Asia. The west was the industrial heartbeat of the world. After all the industrial revolution began in Europe, the US was seen as a powerhouse in manufacturing cars, steel, and take.

No one could ever believe that this could ever change, but it did. A few people saw this coming. They stood up and said things about to change. Manufacturing is about to move away from the west. People laughed at them, thought they were crazy. Then the shift happened. Manufacturing shifted to China, India.

To a lesser extent other parts of Asia like Japan with cars and Vietnam and those who have seen it coming and bet on me are a Chinese billionaire of today. So I’m telling you this now, there’s about to be another shift and this time. Towards Africa, the continent is waking up in an unprecedented manner.

Transformation of core resources will be done more and more on the continent by the largest youth population in the world. Take a look at what’s happening in Burkina Faso with President I, Niger, Mali. They’re all following suit. Niger decided to push out France and mine its own Uranium Ghana is slowly but surely taking control of its gold mines in Nigeria.

Aligote just built one of the biggest refineries on the continent, and this is just the beginning. Recently windows all the hype about electric cars. Being manufactured in, I received so many messages that week. People wanting to invest in electric cars. They had their checkbooks in hand and they were ready to invest, and I had to tell them, chill, guys.

Chill when there’s a hi. It’s often already late. It was already late. You invest in that particular company, but if you’re a member of our community, or you have at least been following us for the past year, we’ve been talking about the opportunity of electric cars in Africa. Some people bought shares and invested in electric car manufacturing companies in Morocco, and when the hike came along, a lot of them took up profits.

Some are still in it for the long haul. They’re looking at the five to 10 years investment. This is just to see Africa is on the rise. And that’s how things will keep on exploring sector after sector, after sector, because the combination of raw materials, the young population, the huge workforce, and a huge consumer base is the exact recipe needed for exponential growth.

This is exactly where China was a few decades ago. It’s like history repeating itself, but people are refusing to take heat. It’s like China minus all the natural resources, which even makes things better for us smart investors. A good example of a company that was started just a few years ago is Junior, which is usually called Amazon of Africa.

Junior went from a startup to be listed on the New York Stock Exchange in less than 10 years, and that’s huge to put things into perspective. It took Coca-Cola, which is an American company, 33 years to be listed on a New York Stock Exchange. It took McDonald’s 25 years to be listed on a New York Stock Exchange, but it took Junior about seven years to do the same.

The third sector prime for growth on the continent is an infrastructure. Africa needs infrastructure as we speak. Africa has an infrastructure market that exceeds $100 billion annually. Yes, you heard me right? Annually, every year, $100 billion goes into the African market construction site. We’re talking all kinds of infrastructure from real estate to roads, railway, hospitals, schools, you name it, Africa needs it.

You build it. You make money that’s a given. Healthcare infrastructure, energy, infrastructure, education, infrastructure, transportation. What are you doing now in the West? Just transfer that expertise and see how you can deliver it on the continent. There’s Jerome, a member of our community who is in cybersecurity in the US and he’s built a consulting business here on the continent and he’s making it killing six figures every month without doing much.

That’s just one success story. A successful investment plan should account for your financial goals. You bought it, your investment timeline, your knowledge of the market, and so many other mitigated factors that are often overlooked by investors. And this can be deadly in a fast moving market like Africa.

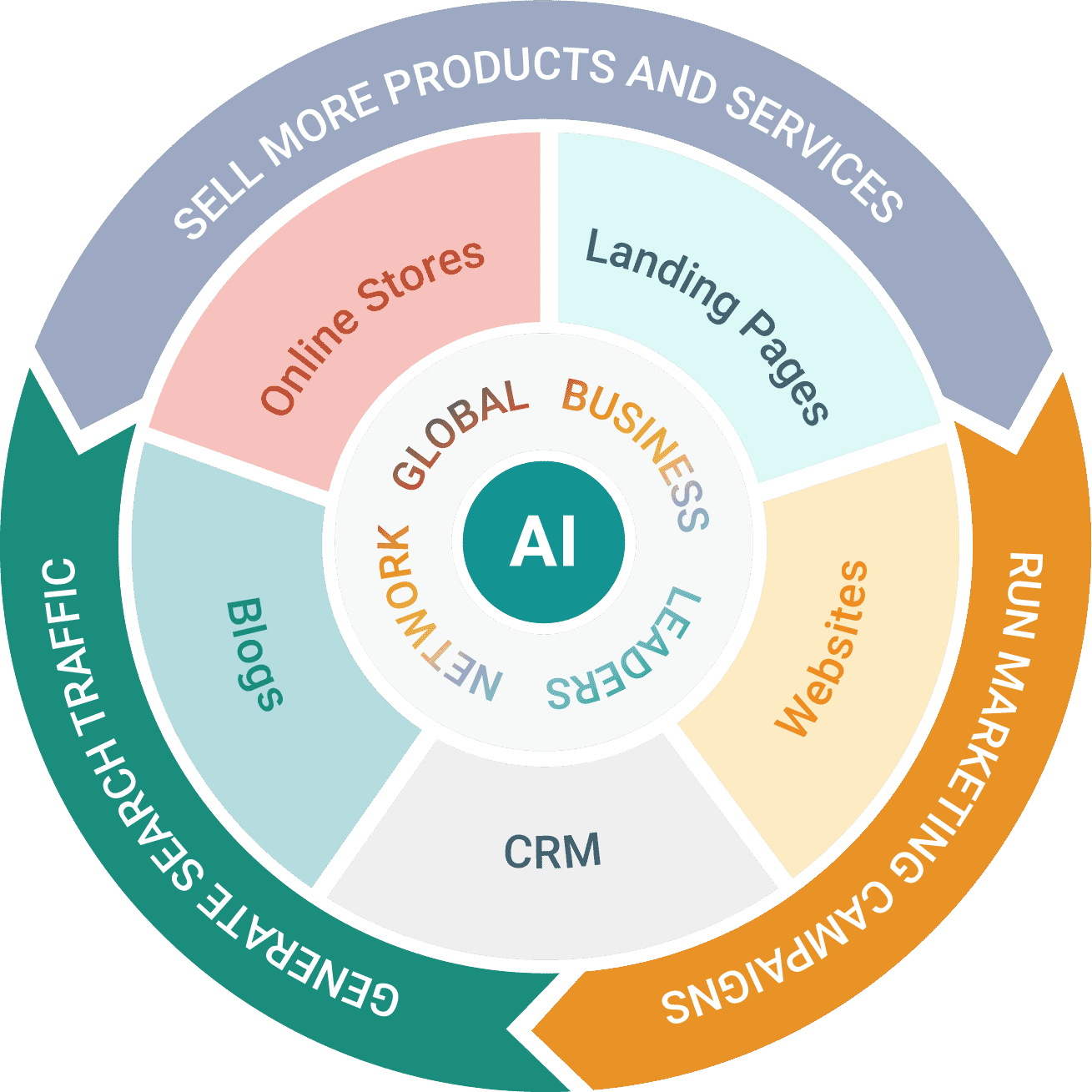

Vital questions. We help our clients answer these questions every day. Should I invest in stocks or should I buy a business? Should I start a franchise? Or should I invest in an existing local business? Should I get a local partner, or should I start from scratch? These are all questions we are monoline investors help fight answers to.

That’s why we’ve come up with our framework investment on the continent. Has to be strategic. It’s not about emotions or sentiment. Our African investment framework bridges the gap and provides a systematic approach towards matching your investment capabilities with opportunities on ground. If this masterclass resonated with you, chances are you lower Upcoming two virtual event where we break down all unique, especially those actionable steps you can start taking today.

To see some of these opportunities on the continent for two days straight, you’ll be able to connect with successful investors that are really active on the African market with local business leaders seeking partnerships with industry experts with on-ground insights, how to navigate the African market, and you also get to implement our framework, will also give you resources to kickstart your journey, will give you sector specific briefs.

We’ll give you an opportunity catalog so you can have a visual of all the opportunities available on the continent and how to better get into them. This event is for people who already see the value in the continent and want to start taking action. They need practical steps. If you also need clarity or guidance, you can always give us a call.

There’s a link down below to book a call, but I urge you to attend this event. You’re dating a lot over a two day period. That would change your entire perspective. You’re coming out at the other end. You are ready to conquer the market. Lemme believe you with this one thought. Every generation has frontier markets that seem obvious in retrospect.

In the 1980s, it was Japan. In the 19 hundreds it was Silicon Valley. In the two thousands it was China and India. Today it’s Africa. And the question isn’t whether extraordinary growth would happen in Africa. It’s whether you’ll be part of it. And remember, first Movers Advantage doesn’t last forever. This is for those who have yet since the beginning.

So the first 10 people from this masterclass to register for a two day event will get a year’s full access to Model Land Investors Network. It’s a community of like-minded people who are already investing the continent. Information as well as opportunities. It’s a community of legends. They usually pay $47 a month to be a member, but if you register to a event from this masterclass, you get one year full access for free just for the first 10 people.

That’s over $500 in value. Unfortunately I can’t answer all your questions on here. There are so many of them. Please join me for our two days live event and I’ll be able to answer most of your questions one on one. You can get your tickets through the link below. See you on the other side.

Source: https://youtu.be/ZPfwkxFcwqk