25 African Startups to Watch

Bloomberg

May 24th, 2025

Jennifer Zabasajja: On this edition of Next Africa, we explore the company’s shaping the continent’s future as Bloomberg unveils, its inaugural Africa Startups to Watch List. We talk with some of the up and coming business leaders driving the charge also. We travel to rural South Africa to find out more about the agritech company connecting livestock farmers to global markets.

Plus thousands of political and business leaders converge on AJA for the 12th annual Africa CEO forum, which aims to bring the public and private sectors together to help deal the continent, a winning hand in an increasingly transactional world.

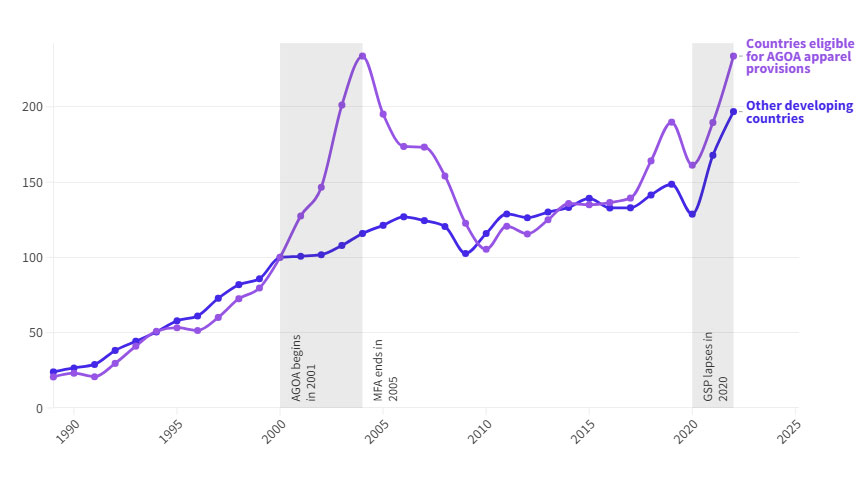

And welcome to Next Africa. I’m Jennifer Zaja, and this month Bloomberg launches our inaugural 25 African startups to Watch List. And we’re taking a deep dive into the startup scene across the continent. Now, the tech startup ecosystem across Africa showed strong resilience in 2024. Global technology investment firm, Partec reports $3.2 billion of funding for last year.

That’s across over 500 deals, but venture capital investing in the region has slumped since 2022. FinTech still dominates, attracting 60% of funding with Nigeria leading the charge across the continent. Startups face macroeconomic headwinds such as currency devaluation. And high interest rates. Yet in the face of shrinking funding, the ecosystem is maturing.

Interest in sectors such as clean energy insurance and logistics are all being driven by the need for scalable solutions within countries experiencing rapid population and economic growth. Now the UN has looked to boost new business through initiatives such as Timbuktu and Africa, influencers for Development.

I spoke to the NDPs Africa Director, una Azi Kawa, who spearheaded that program about what needs to be done to further boost entrepreneurship on the continent.

Ahunna Eziakonwa: It’s doomsday, if you like, uh, for development, uh, programming, uh, and development financing. Uh, because uh, for regions like Africa that are still.

In the middle of, uh, their development journey. Um, the, the current global environment is quite hostile, uh, in terms of generating, uh, sufficient, uh, financial means, uh, to deal with all the development challenges. So this is, um, uh, quite a serious moment, uh, for development because development funding is drying up for one.

Uh, but also the geopolitics and globally the issues around trade. Uh, having a negative impact on actually boosting, uh, global growth, which, uh, you know, eventually means, uh, growth everywhere else. So, no, it’s a, it’s, it’s a, it’s a moment, um, to behold in terms of, uh, shifts, uh, in the wrong

Jennifer Zabasajja: direction. Well, and that brings me to Timbuk too.

Can you talk about the work that you are trying to do in terms of innovation, uh, and empowering local entrepreneurs? Um, how are you operating in this environment, considering the challenges and still, uh, being able to drive some of the innovation that you speak to there?

Ahunna Eziakonwa: Well, you know, we, we think actually that private sector is, is the direction that we ought to go with the overall, uh, decline in development financing.

ODA has gone down sharply, uh, but Africa has not fully leveraged the private sector. And by private sector, I don’t just mean big corporates, I mean small, medium enterprises and, uh, startups. And actually UNDP was put on notice about the potential we have, the opportunity we have on the continent. When a few years ago we saw the emergence within a very short period of time, of six unicorns and an explosion in the startup, uh, space, uh, with investors actually taking notice of that opportunity on the continent.

Uh, now we saw, uh, the startup. Uh, industry in Africa growing six times more than the global average. And that really, uh, caught her attention. And also the fact that, uh, the space was occupied by mostly young people. And these are the ones that we worry about. Because on one hand, Africa has a lot of young people.

On the other hand, the opportunity is a few for them to actually, uh, uh, apply themselves. So the startup. Uh, ecosystem, uh, was, uh, emerging very fast as a place to invest. So, UNDP, uh, decided to establish TIMBUK two, uh, which is the largest initiative in the world to support the Africa startup ecosystem. Uh, to do five things.

One, we wanted to solve this, uh, you know, the early stage risk capital gap, so. Although there was a lot of investment coming into startups, um, VCs were shying away from early stage because of the perceived risk. And yet we know that you need a healthy, you need to grow a healthy pipeline for investors to be interested in.

So timbo to, uh, first, um, objectives to really bring enough capital to bear on, um, solving that early stage, uh, risk capital. The second is actually dealing with the. Whole fragmented ecosystem. What we found was that there was a lot of interest, but there was no coordination or coherence around it. So Timbuktu is generating this, uh, ability for us to concentrate, to converge, um, support, uh, diverse support channels in one location, and also to solve the.

Sort of, uh, sector specific issues. And of course the idea that you really need to go Pan-African. You know, the one Africa market, the Africa Continental free trade area has been launched and startups need to be able to cross borders to have greater ease at operating beyond their borders. So we are also bringing policy to bear regulations that stimulate.

Enterprise rather than stifle them. So that’s, you know, Timbo two has a policy impact, um, team that is working on issues to do with startup Act startup regulations that will just ease the issue a little bit. And finally, is this, um, idea that we need to bring universities on board and Timbuktu wants to address the middle, which is growing Gazelle.

Uh, you know those, um, startups that will scale fast and become companies that are actually employing a lot of people.

Jennifer Zabasajja: The startup space is just one area. Private equity will be keeping an eye on. Let’s bring in Genevieve Santi, partner at Alterra Capital Partners, a private equity investment firm, and Bloomberg’s Loney Prue, who covers deals, tech and m and a on the continent.

Lonie, let’s just start with you. 2024. We saw a deceleration in investments from prior years. How is this year shaping up?

Loni Prinsloo: Yeah, so, um, actually in 20 21, 20 22, we saw quite high valuations and then we had a bit of a correction in the market. That’s what you saw in 2023 and 2024. What happened consequently in 2024 is a few big funds were raised specifically for Africa.

One of them was, um, Genevie UL Alter Fund. That’s going up to $400 million. And she managed to pull quite a lot of interest from billionaires like the Gotti Carlisle founders. Um, Adina raised a fund of, uh, four $70 million. We’re seeing healers, uh, trying, targeting quite a large fund of around $800 million that haven’t closed yet.

But consequently, what then happens if you close those funds, you have to deploy the money.

Jennifer Zabasajja: Yeah. Genevieve, bring, jump in here. I mean, what are you, what are you seeing from your vantage point?

Genevieve Sangudi: So Jennifer, you know, I just came back from Lagos about two weeks ago where the African Private Capital Association was hosting its annual meeting, 800 delegates, um, and from around the world, both from the continent and globally.

So we’re talking institutional investors, development, finance. Institutions, gps as well as as LPs. And what was really also, um, interesting was that, that we had a lot of domestic investors. So you had pension funds, sovereign wealth funds, et cetera. And what I can tell you, I’ve been doing this for 20 years, and the optimism in the room, the energy in the room, the renewed focus on.

Actually working hard to deliver risk adjusted returns for Africa that would be globally competitive, was really, really palpable. So in terms of deal activity, if I even look at Alterra over the last 18 months, we have closed four transactions. We have three more transactions that we are. Actively working on that, we expect to close this year.

Mm. So I think, you know, just looking on, you know, Q1 this year versus last year, I think we’ve already reversed that trend in terms of deal activity. And as Lonnie said, some of our well-respected peers and competitors are raising massive funds. So we expect to see them in the market. I think that there’s still, um, significantly more demand for capital than there is supply.

Hmm. So I don’t. Hope that prices will be driven up as a result of that, but I hope we’re all just gonna invest wisely and continue to make Africa an attractive investment destination for global capital.

Jennifer Zabasajja: But when you look at some of the data points that are out there, and in particular what caught my eye, uh, is the investment to exit ratio, right?

Uh, that is still quite low. If we take a look at the other parts of the world, how does that factor into your sentiment right now as an investor, especially when you’re looking at the startup and the entrepreneurs and, uh, the companies that are out there to invest in.

Genevieve Sangudi: Jennifer, that’s an absolutely accurate point, and it’s something that has to be resolved.

So Africa has suffered from a dearth of liquidity and a dearth of exits in the private equity and venture capital space, and that is part of what has made sort of, you know, capital flows into the sector lower than they should be. However, it’s a. Big continent, right? 54 countries. Very different macro, social political dynamics.

If you look at just the data in terms of the number of funds that the African Private Capital Association tracks, it’s something like four 50. Wow. Which just imagine how broad a spectrum that is. Right. So if you look at the macro numbers, I see why that. Makes sense. However, if you look at top decile managers, I think the trend then looks very different, which I think is how we need to dissect the data as we look to present Africa as an attractive, um, investment destination.

And so I think the lesson for all of us here should be by good companies, maintain pricing discipline, be a very value added hands-on investor. And from an Alterra perspective, we find that it’s easier to, to exit control investments. You are in control of your destiny. You are able to do ESG and tech transformation, which I think makes companies more sustainable, more resilient, and more attractive to, you know.

Uh, global strategic, uh, players and financial investors

Jennifer Zabasajja: and some of those points that you brought up there. Um, loney, uh, tech sustainability, scalability. I mean, those seem to be a, a lot of the describing factors for the unicorns that we see on the continent, which are quite small. Uh, is your expectation based on your reporting that we’ll see more unicorns in the near term in 2025, or is it shaping up to be a few smaller companies that are maybe more scalable that we’ll, we’ll see a rise.

Loni Prinsloo: So in terms of unicorns, as I sort of previously mentioned, we had some big ones come through, mostly from Nigeria. We had a flatter wave, um, at those high evaluations that we talked about previously, um, backed by a lot of us, um, money and so on. What we are noticing all sort of as I do the reporting going along, um, we are seeing some South African companies, um, building a bit of scale.

We saw Time Bank recently become a, the first unicorn actually in South Africa. Um, there’s some other payments companies that are doing well, maybe not quite yet at unicorn, um, z might, might make it this year, next year. Wow. So not many unicorns, but, um, companies are definitely building scale. We recently did 25 African startups to watch.

Yeah. So that’s smaller scale. But, um, it’s very interesting to go through the data and the between some of them they are planning be great. Well, smaller raises, but you know, that’s how you build your scale. That’s where it start. And then Genevieve comes in at a later stage.

Jennifer Zabasajja: We’re gonna leave it there.

Thank you so much to Genevieve Santi, a partner at Alterra Capital Partners and also Bloomberg’s Loney, prince Lu, uh, who covers deals, tech and m and a for us here on the continent. Now coming up, we’ll take a deep dive into one of Bloomberg’s African startups to watch and look at how a South African company saw an opportunity to connect livestock farmers with global capital.

But first CoolBox is a solar refrigeration company operating in Nigeria, which also made our list CEO Aula. Dominic shared more about the inspiration behind his startup.

Ayoola Dominic: We have this huge, this program in Africa, we’ve always been hearing about, let’s, let’s light up Africa, let’s light up Africa. But rarely do you hear people talk about, let’s refrigerate Africa.

And that’s the problem we’re trying to solve. So about two and a half years ago, we created a solution using the forces of nature, which is the southern water. We are able to generate reputation using the sun and water. And the good thing is we’re able to store energy in the form of ice. As opposed to storing energy in the form of medium batteries.

And the question is of raw good is the technology if no one can afford it. So looking at the peculiar nature of the people we serve in Africa, we are integrated in every refrigerator, a pay as you go, technology, allowing individuals and small businesses to be able to pay as low as $10 to own a refrigerator.

Sneha Mehta: So Uncover is a women’s wellness brand that is specifically made for women of color. It’s based in Africa, which is the most underserved beauty market in the world. The gap in product. Is huge. There is very little choice that is affordable, high quality, effective, nourishing, and safe. The second gap that we identified was actually knowledge.

It’s actually bigger than the products gap. We started in Kenya with one product category and about a thousand Instagram followers. Today we are sold across six African markets, Kenya and Nigeria being our big hub. We have 14 products and we have a community of 250,000 women that social followers and email subscribers that are consuming our content.

Jennifer Zabasajja: That was the founder of Uncover another one of the company’s profiled on Bloomberg’s Africa Startups to Watch List. Now from cosmetics to Cattle Swift Via is an agritech company connecting livestock farmers to global markets. I visited rural South Africa to see what it’s all about.

Russel Luck: Two 50 inside. All done.

Jennifer Zabasajja: That’s the sound of antelope being sold at auction. It’s big business in South Africa where more than 20 million large wild animals roam on private land around the country. Everything from buffaloes to wart hogs are bred and traded. The country’s thriving wildlife auction circuit means today they can fetch up to a million dollars each.

It’s a key piece of the industry drawing interest from far and wide. Even president Zero Reup who has bid over a million dollars for a buffalo, the government hopes auctions may help boost black ownership. Currently just 3.5% of the wildlife sector. It’s also creating markets for rural farmers, which can support prices for centuries.

Farmers have relied on live agriculture auctions like this to buy and sell livestock, but technology is revolutionizing the way that they do it.

Desry Lesele: If they can do auctions online instead of driving to their auctions, that will save them the cost. And that’s why we look into technology as a way of enhancing the whole value propositions that we offer to farmers.

Jennifer Zabasajja: Russell Luck is the founder and CEO of Swift. F. Swift refers to the global payment system, and FIA means livestock in afri. The app matches buyers and sellers of livestock anywhere in the world. No. His team traveled to remote auctions across Africa, fielding online bids alongside those over the phone or in person, making it a far more competitive scene.

At the conclusion of this auction, for example, half of our wildlife went to online bidders, and if you’re a winner, another company will help get the animal to you.

Russel Luck: We’re working with key banking partners in order to open up a whole range. Of FinTech, InsureTech, and data solutions, which will empower farmers to sell at higher prices.

Jennifer Zabasajja: Auctioneers say sales have grown almost 800% since apps such as Swift F started. Luck has raised over $2 million in venture capital and from other sources, including the Bill and Melinda Gates Foundation. It’s also been recognized by the United Nations. Thousand Swift is now eyeing the US market where luck hope’s growing interest in his auction app.

We’ll turn into a stampede

and the company says it’s able to help more than 249 million women in Africa who keep livestock as a primary form of financial security. Enigma Ventures, another firm focused on female-led startups, believes Africa is at the vanguard of women-led initiatives in the private sector. I spoke with Sarah Dusik, founder of the VC Firm as part of our investing Africa series.

Sarah Dusek: Africa is actually leading the charge in investing in women. Africa has an unusual situation in that 50% of entrepreneurs in Africa are female. More and more funds are putting more and more energy into investing in women and investing in women on the continent. The real shift that has to happen on the African continent is the amount of money being invested.

So we’re still seeing, sadly, minuscule amounts. Of capital being deployed on the continent in comparison with other continents, Africa is ranking lost in the venture capital stakes.

Jennifer Zabasajja: African business leaders have been wooing investors with the aim of forging a new public private deal to speed up the continent’s economic transformation. This month’s Africa’s CEO forum brought together more than 2000 business leaders, investors, and policymakers in Aja. The Ivory Coast economic hub among the attendees was Ghanaian President John Muhammad.

He told me more about plans to encourage crude extraction to avoid the assets from getting stranded amid a global decarbonization push. But Moham says gold remains key.

John Mahama: Our major exports are gold. Followed by oil and gas and then cocoa. Cocoa used to be the biggest export item for Ghana. Um, I think it’s about number three now because of, um, um, a loss of production due to climate change.

But it’s building back up and so while oil has gone down, we benefit from the gas. Because I think that gas is more beneficial to Ghana than the oil because we’re using gas to produce power. Yeah. And it allows us to produce power comparatively lower. Uh, than if we’re using light crude oil completely.

Fortunately, the West African Power Pool, uh, is operational and so any excess power we’re able to ate to Brook Faso and other countries. And so that’s a good thing. But, um, in all the unpredictability of the world and when the world gets unpredictable, um, one commodity that increases in price is gold.

Yeah. And, um, there’s gold everywhere in Ghana from the south to the north. Um, in the past when we were young, uh, when there was a thunderstorm and you went out, you could pick little specks of gold in the gold producing areas of Ghana. So gold, I can need

Jennifer Zabasajja: to go to Ghana.

Let’s bring in Bloomberg Yinka, IBU, uh, who is in Accra for us, uh, another gold part of the country. Uh, Yinka. Talk about how this year’s forum was different to previous editions. I know you’ve covered this for quite a few years now.

Yinka Ibukun: Yes, Jen. This year’s forum was really different. They were, first of all, this started really as a small conference in Geneva in 2012 that kind of bridged the investment communities in Africa and outside to do business together.

It’s grown into this, uh, huge event that, um, brought together 2,800 plus. Um. Business leaders and political leaders. Um, as you just said, you know, you were with ham on stage. There were actually at least seven presidents present for the event, which has grown really from this francophone of bear to this Pan-African one, and it’s in fact been called the African Davos.

Another highlight was when Rama of South Africa, president Osa and President. Paul Kaar may share the stage and even pleasantries within a very difficult political context. Of course.

Jennifer Zabasajja: Yeah. And, and, and Yinka you mentioned the difficult, uh, political geopolitical con context. We talked to a lot of people about that throughout the whole gathering.

What would you say for investors, some of those key takeaways though, who are, you know, the investors who are interested in the continent? What were the takeaways considering a lot of the uncertainty. So really they were

Yinka Ibukun: all the ingredients for the mood to be gloomy. But actually, um, it was quite optimistic.

Despite all of this, I spoke to A-C-E-O-A bank, CEO, who was saying that he was expecting people to be sharing concerns, and instead they were sharing ways in which they could adapt to the situation. And so in terms of takeaways, one key. Uh, conversation that came up was, especially for the huge infrastructure projects that, uh, Africa needs was resorting to blended finance, which is basically having development funders, um, de-risk projects so that more capital in those can come in.

Um, that’s been a term that’s been flowing for quite a bit, but I think, you know, um. Necessities, the mother of invention, and we’ll probably see more in that space.

Jennifer Zabasajja: Certainly only two days, but quite a busy two days. It was Bloomberg in Afra. Thanks so much for that update and for joining us, uh, this month, and that’s next Africa for this month.

But don’t forget our weekly podcast with more of what’s happening across the continent, available on Apple, Spotify, and wherever you usually get your podcasts. You can also subscribe to our biweekly Next Africa newsletter available on the terminal and website for even more reporting from the Bloomberg team.

But for now, I’m Jennifer Zaja and Johannesburg. We’ll see you next time.

Source: https://www.bloomberg.com/news/videos/2025-05-24/25-african-startups-to-watch-bloomberg-next-africa-video